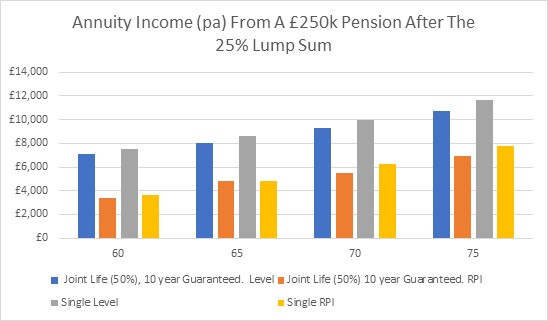

single life annuity with 10 years guaranteed

You can choose a single life pension option if you are single or your spouse has given up their rights to your pension. You can choose a single life pension option if you are single or your spouse has given up their right to your pension.

People ages 55 to 75 may benefit most from the guaranteed income of an annuity.

. In the event the pensioner dies before receiving 120 monthly pension payments the monthly pension will continue to be paid. Payments will commence in one month. However no payments would be available for the beneficiary.

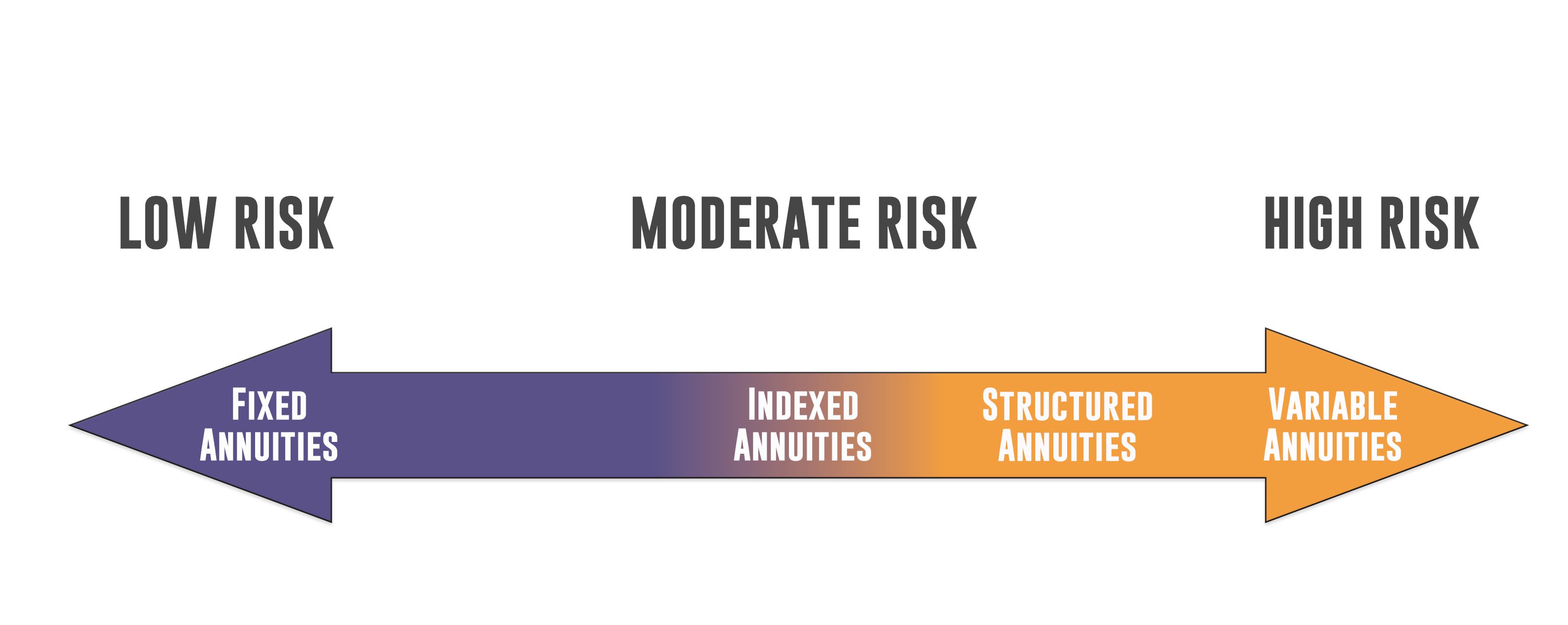

It is insulated from the market booms and busts. Multi-year guaranteed annuities or MYGAs are a type of fixed annuity that guarantees a fixed interest rate for a specified time period usually three to 10 years. Annuities are investments that pay.

Single life male 10 year guarantee. After the 10 years initial guarantee period you will have the option to either renew for another 10 year period at the. Monthly incomes based on a premium of 100000 of registered funds.

New York Life charges relatively standard fees of 30 to 40 annually and a 120 to 160 mortality and expense. Related to 10 Year Certain Single Life Annuity. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years.

The annuity is paid for life that increases at a rate of 3 every year. A ten-year fixed annuity pays a guaranteed interest rate for 10 years. A life annuity can be purchased on a single life or on joint lives.

For example if you purchase a single. With a single life pension you can choose a lifetime monthly pension. The lifetime of the purchaser.

Older people in their late 70s and. Single life male 10 year guarantee Financial Institution Age in Years. For an annuity to be considered an immediate annuity guaranteed income payments must begin within the first twelve months after purchase.

If not that is not the case. An immediate annuity provides income to the purchaser that starts as soon as they deposit a lump sum. This form provides a monthly pension to the Pensioner for life.

If the annuitant outlives the five years of guaranteed payments they will continue to receive income payments for life. Means a Single Life Annuity except that if the individual receiving the annuity should die before annuity payments have been made for. Define Single Life Annuity With Ten Years Certain.

With a single life pension you can choose a lifetime monthly pension. Single Life Annuity means an annuity providing equal monthly payments for the lifetime of the Member with no survivor benefits. New York Life has earned an A AM Best rating.

The payments last for.

Lincoln Lifetime Income Advantage 2 0 Lincoln Financial

Aig Life Retirement Introduces 5 Year Index Annuity For New York

What Is An Annuity Meaning Definition Benefits Types

Fixed Annuities Guaranteed Income For Life Usaa

Difference Between Life Insurance And Annuity Plans

What Is A Joint And Survivor Annuity Thrivent

Fixed 5 Year Single Premium Deferred Annuity Disclosure Kjzt

Immediate Annuities Income Annuity Quote Calculator Immediateannuities Com

Are Low Interest Rates Stopping Your Clients From Securing Income Guaranteed For As Long As They Live Advisor S Edge

Lic Jeevan Shanti Guaranteed Pension For Life Plan Review By Grow Wealth Advisors Grow Wealth Advisors

Pdf Supply Challenges To The Provision Of Annuities Semantic Scholar

What Is The Right Age To Buy An Annuity Plan

Delaware Life Pinnacle 10 Myga Annuity Cd Rate Alternative

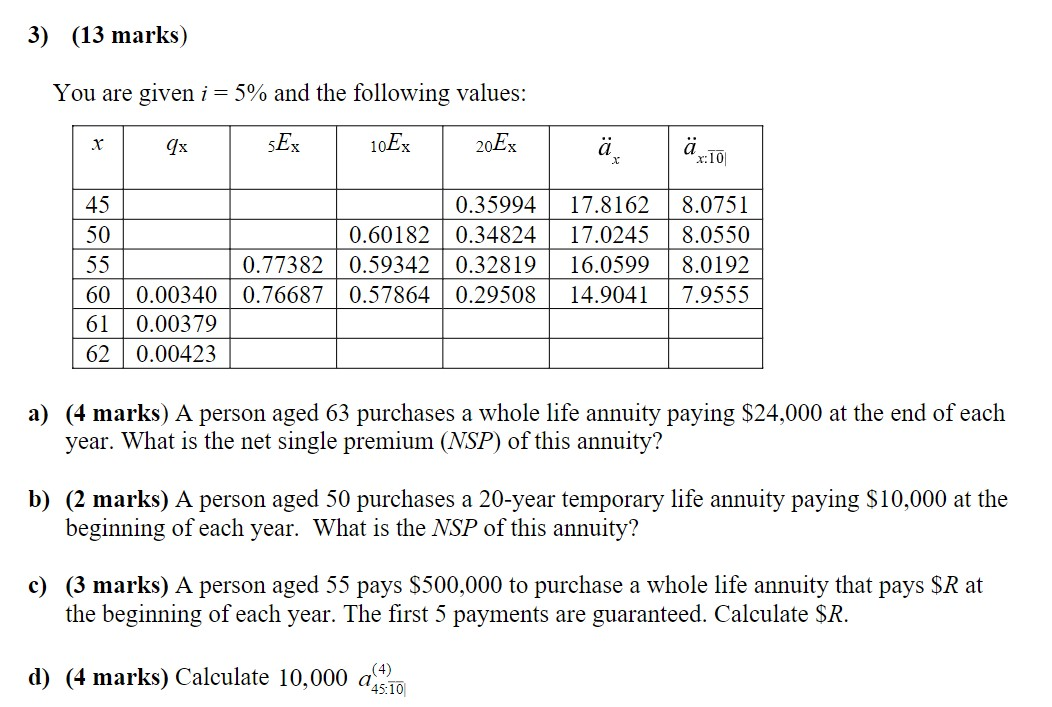

3 13 Marks You Are Given I 5 And The Following Chegg Com

Pension Annuity Retire With A Guaranteed Income Nerdwallet Uk

Have Annuity Rates Gone Up Bogleheads Org

Annuities The Sheep In Wolves Clothing Neligan Financial

.png)